23+ Ab Trust Diagram

They were designed primarily to reduce or eliminate. Increased exemptions for federal.

W6emdypnueyhvm

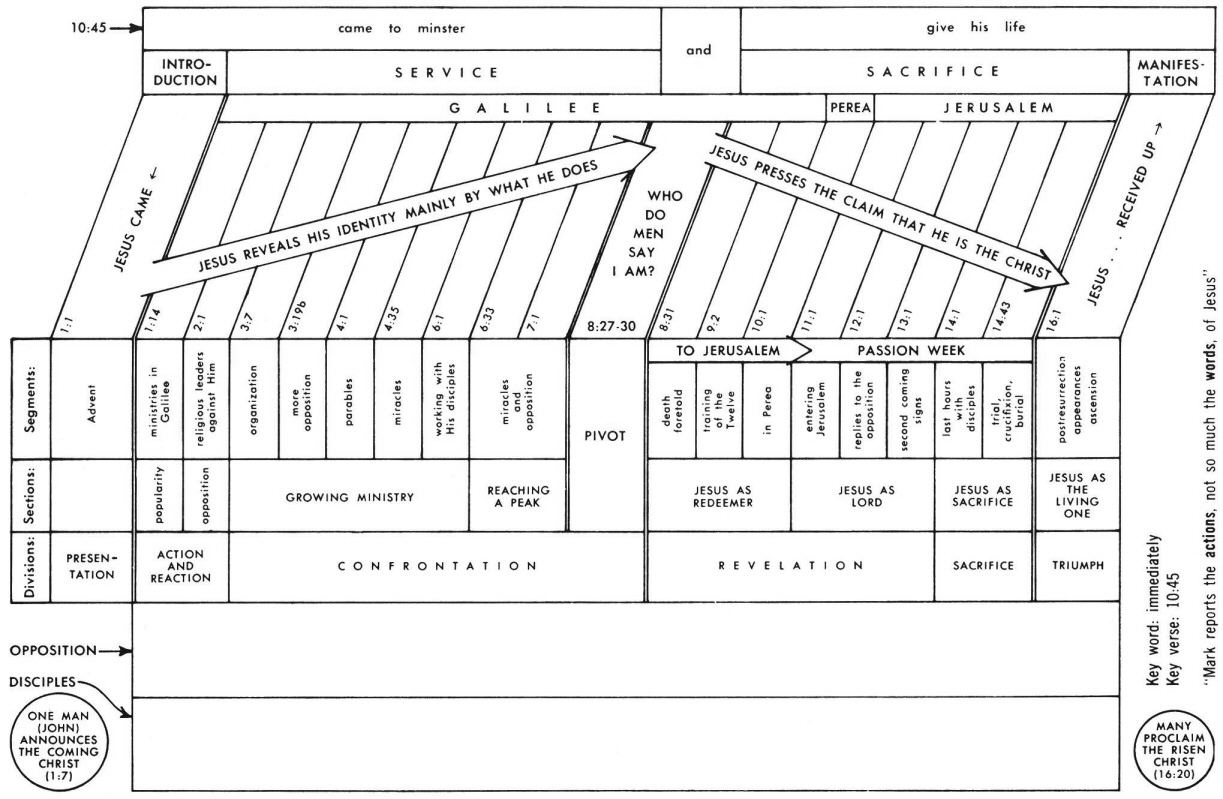

How an AB Trust Works Under the old tax laws each spouse had an.

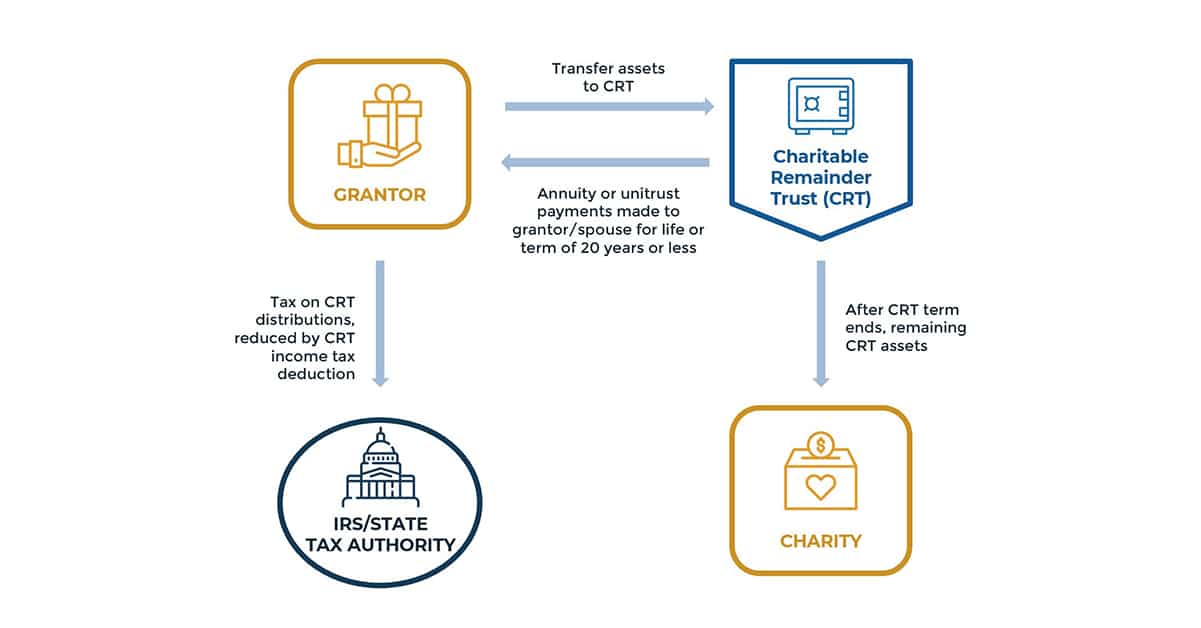

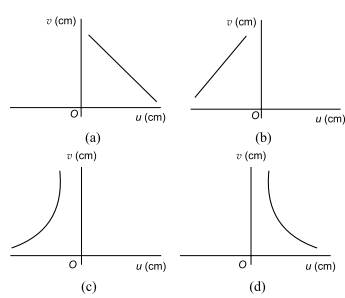

. Web An AB trust is a legal arrangement for married couples that can minimize estate taxes by splitting assets between two separate trusts when one spouse dies. Web Figure 1. Web A bypass trust also called an AB trust or a credit shelter trust was designed to prevent the estate of the surviving spouse from having to pay estate tax.

Web An AB Trust is a specific type of planning available to married couples. This joint Trust allows the estate to be. Web See the diagram below which illustrates how an AB trust works.

The A trust is revocable and the surviving spouse has the power to. Web This is for federal estate tax or death tax planning purposes. Web A bypass trust also referred to as a credit shelter trust or a tax exemption trust is an estate planning tool commonly used in trust designs referred to as AB.

Web The AB Trust is set up in such a way that they can effectively transfer two times the maximum federal estate tax exemption to their heirs without encountering. An AB Trust was often a recommended strategy to help minimize estate taxes on the death of the first. This trust is funded.

Web Several big developments in the law have made AB truststhe most common kind of tax-avoidance trustmuch less desirable or needed. Web An AB Trust is a Trust created by married couples to help minimize estate taxes for the surviving spouse after one spouse passes away. AB and ABC Trust Diagram The following statements are true about the A trust.

Web updated September 1 2023 4min read An AB trust is an estate planning tool that can be used when leaving assets to a spouse. Web The American Taxpayer Relief Act of 2012 has added an exemption portability which allows the decedent to leave any unused estate or gift tax exemption. Below is a diagram that provides an overview to explain how an A-B Trust works.

These trusts are known as AB or ABC Trusts. There are benefits to AB trusts but because of. Web An AB trust is a trust created by married couples to maximize their federal estate tax exemptions and can be a tax-saver.

Web An A-B Trust is structured to maximize the tax exemption of both spouses estates. Web For most married couples it eliminates the need to create an AB trust or bypass trust to avoid estate tax. Web A trust diagram analyst examines all the pieces of the puzzle or rather all components of the system users processes data storage locations etc evaluates their interactions.

Learn about revocable trusts irrevocable. This is a high-level explanation and cannot be interpreted as advice specific. Web An AB trust is a joint trust commonly created by a married couple to minimize estate taxes prior to the considerable increase in federal estate tax exemption.

Web An ABC Trust sometimes referred to as a Q-TIP or Qualified Terminable Interest Property Trust is similar to an A and B Trust in purpose and function.

Mark N Musial Esq

Charitable Remainder Trusts Crts Wealthspire

Unit Trust Fund Model Download Scientific Diagram

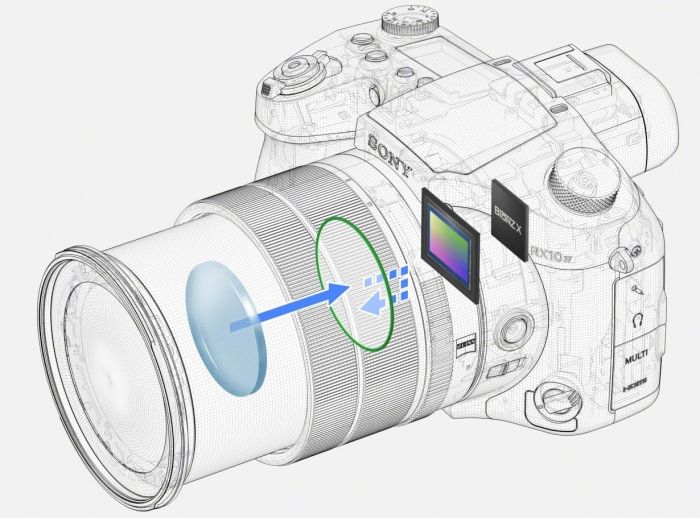

Sony Dsc Rx10m4 Foto Erhardt

Should I Use An Ab Trust Pros And Cons Financial Alternatives

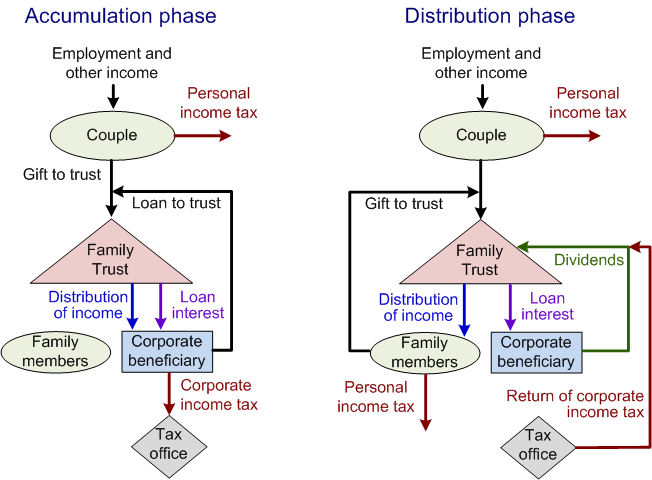

Why All The Fuss About Family Trusts

Made A Chapter Dependency Chart For Physics R Jeeneetards

Universal Expression And Dual Function Of The Atypical Chemokine Receptor D6 On Innate Like B Cells In Mice Sciencedirect

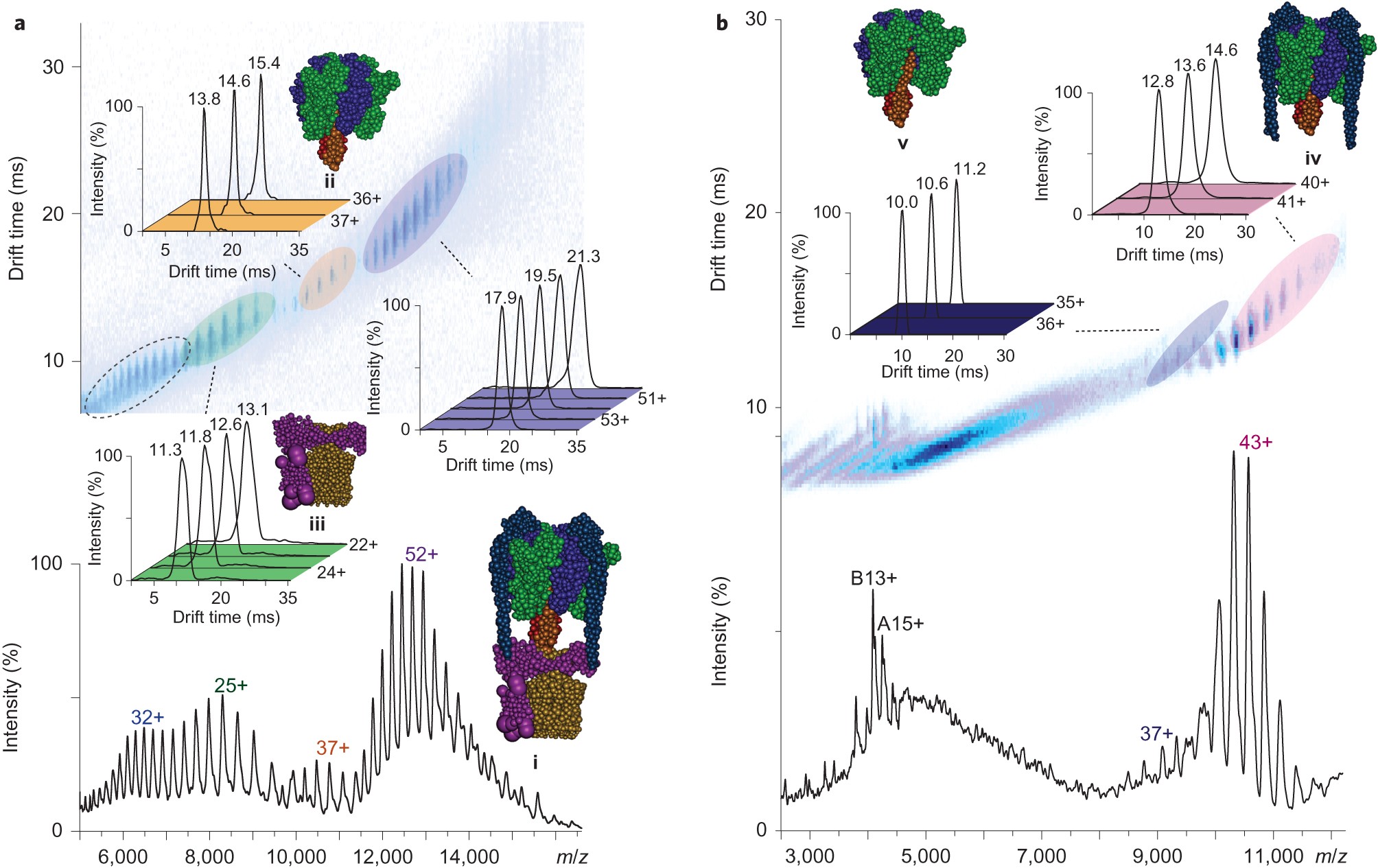

Ion Mobility Mass Spectrometry Of A Rotary Atpase Reveals Atp Induced Reduction In Conformational Flexibility Nature Chemistry

Ab Trusts Everything You Need To Knowwhat Is An Ab Trust Klenk Law

Introducing Everything Disc

Get Answer 1 The Refractive Index Of Glass Is 1 520 For Red Light And 1 525 Transtutors

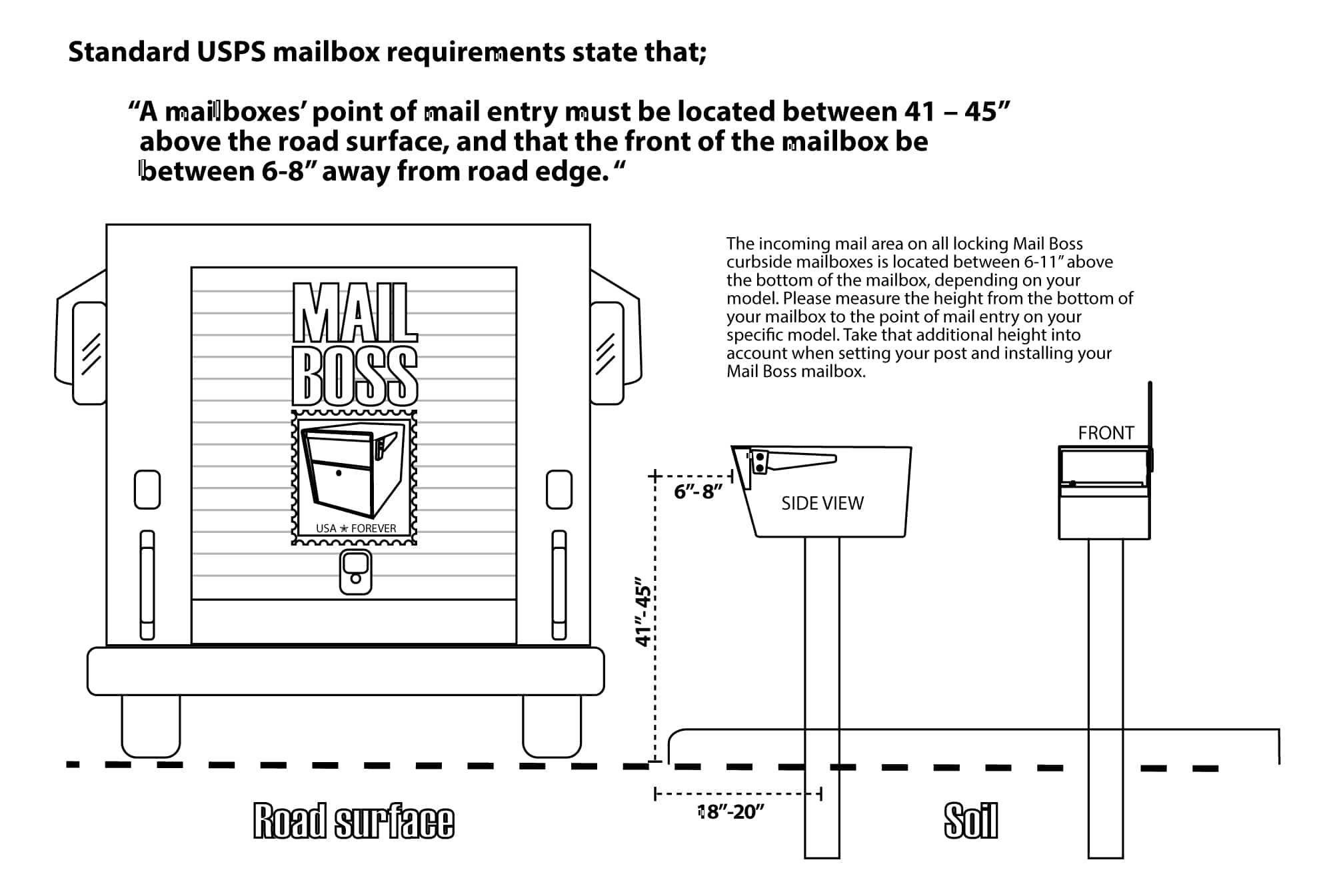

A Guide To Usps Mailbox Regulations

Sony Dsc Rx10m4 Foto Erhardt

:max_bytes(150000):strip_icc()/GettyImages-1250348419-ab662d9137d44cd0aa98f29ac99591b6.jpg)

What Is An Ab Trust

A Complete Guide To Flexbox Css Tricks Css Tricks

Mark 7 Commentary Precept Austin